ATM Withdrawal Limits and Charges: Key Details for SBI, HDFC and ICICI Customers

With the increasing use of ATMs for cash withdrawals, knowing the limits and charges associated with different banks is crucial. While ATMs offer convenience, certain withdrawal restrictions and charges vary from bank to bank. Here’s a comprehensive look at the latest ATM withdrawal limits and charges for major banks in India.

# What is an ATM Withdrawal Limit ?

The ATM withdrawal limit refers to the maximum amount of money that can be withdrawn from an account per day. This limit varies based on the bank, the account type, and the type of debit card used. Typically, withdrawal limits range from ₹20,000 to ₹3 lakh, depending on the bank.

# ATM Withdrawal Limits and Charges at Leading Banks

Each bank sets its own withdrawal limits and charges. Below are the details for some of the top banks in India.

SBI (State Bank of India)

Withdrawal Limit: ₹40,000 to ₹1 lakh

ATM Charges:

- At SBI ATMs: Free for up to 5 transactions, beyond that ₹20 + GST

- At Non-SBI ATMs: ₹20 + GST per transaction

- Foreign ATM: ₹100 + GST + 3.5% of transaction value

HDFC Bank

Withdrawal Limit: ₹25,000 to ₹3 lakh

ATM Charges:

- At HDFC ATMs: Free for up to 5 transactions, then ₹21 + taxes

- At Non-HDFC ATMs: ₹21 + taxes per transaction

- Foreign ATM: ₹125 + taxes

ICICI Bank

Withdrawal Limit: ₹25,000 to ₹3 lakh (depending on the card type)

ATM Charges:

- At ICICI ATMs: Free for 5 withdrawals, then ₹20 per financial transaction, ₹8.50 per non-financial transaction

- At Non-ICICI ATMs: ₹20 per transaction

- Foreign ATM: ₹150 minimum

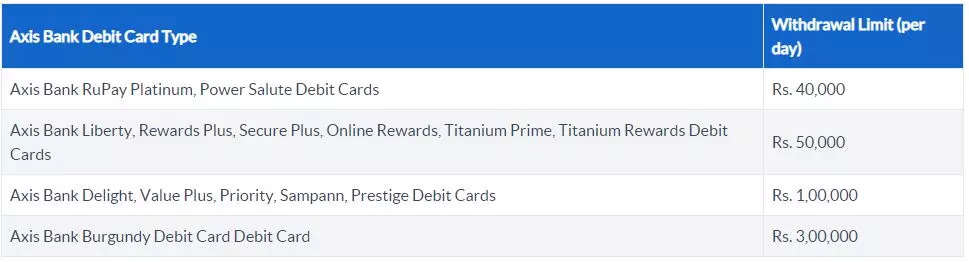

Axis Bank

Withdrawal Limit: Based on debit card type

ATM Charges:

- At Axis ATMs: ₹21 after 5 free withdrawals

- At Non-Axis ATMs: ₹21 per transaction

- Foreign ATM: ₹125 per transaction

Bank of India (BOI)

Withdrawal Limit: Based on debit card type

ATM Charges:

- At BOI ATMs: ₹21 after free 10 withdrawals

- At Non-BOI ATMs: ₹21 per transaction

- Foreign ATM: ₹125 + currency conversion fee (2%)

Canara Bank

Withdrawal Limit: ₹75,000 per day for the Classic Debit Card

Other Limits:

- POS (Point of Sale) Limit: ₹2 lakh per day

- Contactless Limit: ₹25,000 per transaction

# How to Avoid ATM Charges

You can save on ATM charges with a few simple tips:

- Use Your Bank’s ATM: Stick to your bank’s ATMs to avoid additional fees.

- Limit Non-Essential Transactions: Use net banking or mobile apps for non-cash needs like account statements.

- Use Partner ATMs: Some banks have partnered with others to allow fee-free transactions.

- Pay Bills Online: Avoid withdrawing cash to pay bills; opt for online payments instead.

- Use Card Swipes: Swipe your debit card for payments instead of withdrawing cash.

# Current ATM Transaction Rules (As per RBI)

- Transaction Limit: ₹21 per transaction after exhausting the free monthly limit (usually 5 transactions).

- Purpose of Fee Increase: The Reserve Bank of India (RBI) allows banks to charge these fees to cover increasing operational costs and interchange fees.

Before making ATM withdrawals, it’s essential to be aware of your bank’s withdrawal limits and the associated charges. These may vary based on the type of debit card you hold and the bank's terms and conditions. Staying informed can help you avoid unnecessary fees and manage your finances better.