Two-Wheeler EV Sales Pick Up Pace In October; Ola Electric Regains Some Lost Market Share

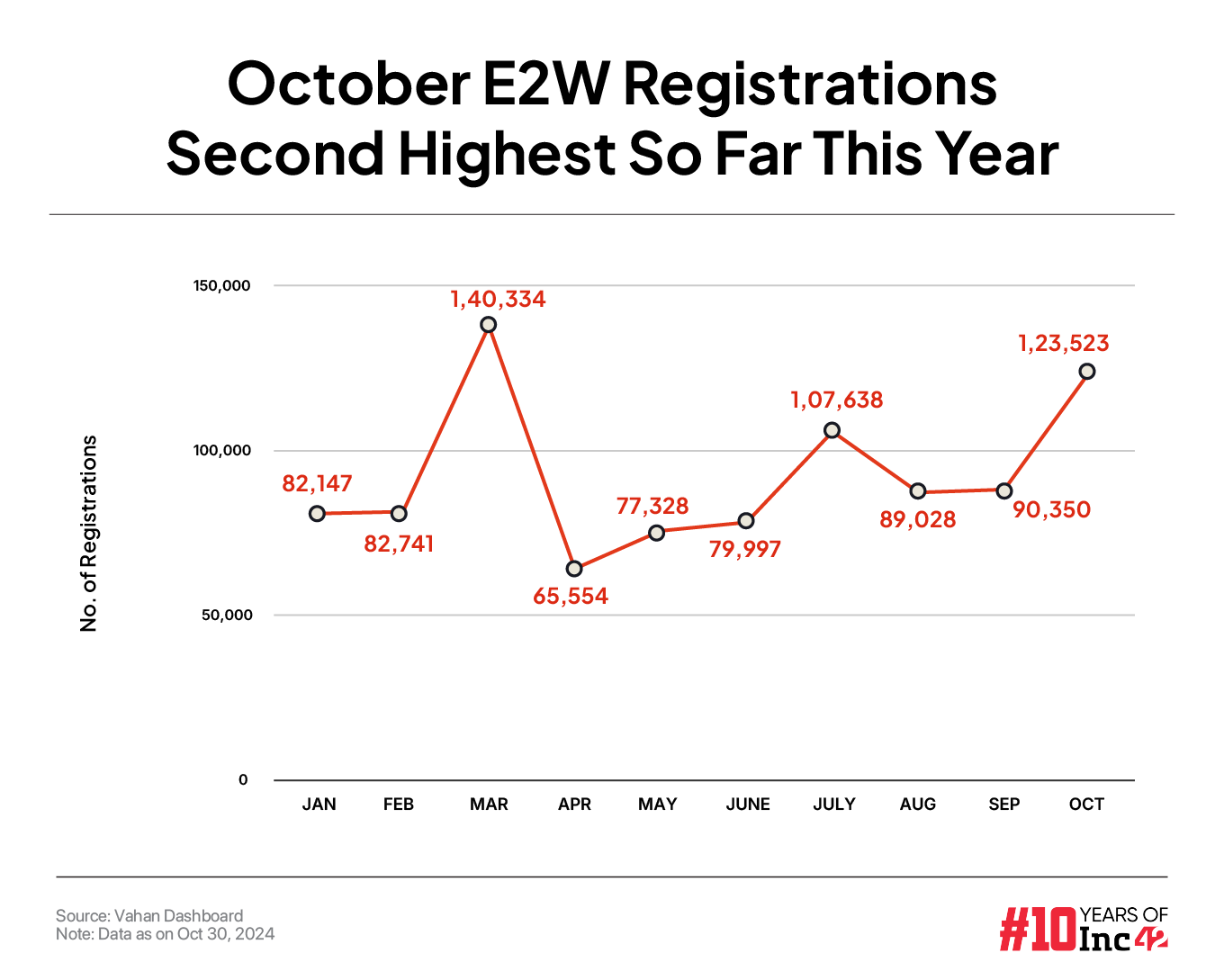

The electric two-wheeler registrations in India shot up by almost 73% month-on-month (MoM) to cross 1.2 Lakh units in October this year on the back of festive season sales discounts.

As per Vahan data as of October 30, two-wheeler EV sales were the highest during the month since March this year when the numbers touched 1.4 Lakh units ahead of the end of the Centre’s FAME-II scheme.

In September, the vehicle registrations increased merely 1.5% MoM to 90,350 units.

Led by Ola Electric’s increased registration volume, the total two-wheeler EV sales witnessed a significant 64% rise on a year-on-basis in October this year.

In fact, after a steady decline in its registration in the last two months, Ola Electric’s volume jumped 49% to 36,865 units in October from 24,715 units in September and 27,613 units in August.

The Bhavish Aggarwal-led listed startup gained momentum in its monthly escooter sales .

In the past few weeks, the matter has received increased focus amid Aggarwal’s public spat on social media with comedian Kunal Kamra who brought fresh attention to the EV maker’s quality and servicing issues.

While Ola Electric regained some of its lost market share in October (at about 30%), it is also pertinent to note that the startup announced massive festive season discounts on its product during the month.

In the first week of the month, Ola Electric launched its BOSS – Biggest Ola Season Sale – campaign for the festive season where it sold its 2 kWh Ola S1 for INR 49,999, which starts at INR 74,999. Besides other discounts across its S1 portfolio, the EV startup introduced festive benefits of up to INR 40,000, which included Hypercharging credits, MoveOS+ upgrade, and more.

While the major offers were only for two days, by the end of October, Ola Electric rolled out another ‘72 hours Rush’ offer window with discounts of up to INR 25,000 on the S1 portfolio and additional benefits of up to INR 30,000.

It is important to note that amid rising competition, Ola Electric’s market share in the EV two-wheeler space fell to 27% in September from a little over 30% in August.

Meanwhile, Ola Electric’s competitors maintained their steady growth with TVS Motor’s escooter registrations rising by over 45% to 26,500 units in October from 18,217 units in September. The legacy two-wheeler player saw its market share in the EV space increase to 21.4% from 20.2% in the previous month.

TVS Motor also introduced discounts of up to INR 20,000 across its iQube escooter range.

Meanwhile, TVS Motor once again surpassed Bajaj Auto in monthly sales as the latter saw about a 31% MoM increase in its escooter registrations to 25,124 units in October.

Bajaj surpassed all its EV competitors except Ola Electric last month with a total vehicle registration of 19,198 units with its market share growing to 21% from 19% in August. In this month, its market share dipped slightly to 20%. Bajaj also rolled out special festive season discounts for its Chetak escooters on Flipkart and Amazon.

On the other hand, IPO-bound Ather Energy also saw an increase in its vehicle registrations this month, albeit at a lower rate than its top peers. Ather’s total registration volume increased a little over 10% to 14,237 units from 12,829 units in September.

Ather, too, introduced certain festive offers during the month, including discounts worth up to INR 25,000 for the 450X and the 450 Apex escooters. However, amid the cutthroat competition in the market, the startup’s market share fell to 11.5% in October from a little over 14% in September.

Meanwhile, October was largely positive for most electric two-wheeler players besides the top four. Even Okinawa Autotech, which has mostly lost its relevance in the market from being one of the top players, saw its sales rise over 46% MoM to 214 units.

On the other hand, Hero MotoCorp is growing at a steady pace. Its EV registrations grew 52% MoM to 6,571 units in October.

However, there is no respite for Ampere Vehicles and Hero Electric whose monthly EV registration fell 51% and over 10%, respectively, during the month.

The newer EV startups including River, Ultraviolette, and Oben Electric are also witnessing a rising demand, but volatility persists in their growth trends.

Overall, the total EV registrations in India across categories surpassed 2 Lakh units in October growing from 1.67 units in the month before. This also marked an over 45% jump on a YoY basis.

Reiterating his confidence in the growing EV space, transport minister Nitin Gadkari recently said that annual EV sales in India will .

The post appeared first on .